lunarland.ru News

News

Best Individual Retirement Account

Individual retirement accounts (IRAs) are retirement savings accounts with tax advantages. · Types of IRAs include traditional IRAs, Roth IRAs, Simplified. No matter how near or far off your retirement is, the tax advantages of an Individual Retirement Account can be too great to pass up. · Traditional IRA · Roth IRA. Best IRA Accounts for August · Our Top Picks · Fidelity Investments · Charles Schwab · E*TRADE · Wealthfront · Betterment · Merrill Edge · Vanguard. Let your earnings grow tax-deferred and pay taxes later upon withdrawal. A traditional IRA has no income limitations and may be a good choice if you think your. Of these, (k) plans and IRAs are among the most common. Before choosing the retirement savings accounts that are best for you, consider your financial. Available for rollovers and transfers, too! Our no-fee Traditional or Roth Individual Retirement Account (IRA) is a great way to save for the future. An IRA. Best for low fees: Charles Schwab IRA · Best for beginner investors: Fidelity Investments IRA · Best for experienced investors: Vanguard IRA · Best for hands-off. Save for retirement with a tax-advantaged TIAA IRA. Choose from Traditional IRAs, Roth IRAs, rollovers & find the best IRA investments for your goals. An IRA can be a good retirement investment for anyone. Think you'll be in a lower income bracket when you retire? A traditional IRA can help you save now with. Individual retirement accounts (IRAs) are retirement savings accounts with tax advantages. · Types of IRAs include traditional IRAs, Roth IRAs, Simplified. No matter how near or far off your retirement is, the tax advantages of an Individual Retirement Account can be too great to pass up. · Traditional IRA · Roth IRA. Best IRA Accounts for August · Our Top Picks · Fidelity Investments · Charles Schwab · E*TRADE · Wealthfront · Betterment · Merrill Edge · Vanguard. Let your earnings grow tax-deferred and pay taxes later upon withdrawal. A traditional IRA has no income limitations and may be a good choice if you think your. Of these, (k) plans and IRAs are among the most common. Before choosing the retirement savings accounts that are best for you, consider your financial. Available for rollovers and transfers, too! Our no-fee Traditional or Roth Individual Retirement Account (IRA) is a great way to save for the future. An IRA. Best for low fees: Charles Schwab IRA · Best for beginner investors: Fidelity Investments IRA · Best for experienced investors: Vanguard IRA · Best for hands-off. Save for retirement with a tax-advantaged TIAA IRA. Choose from Traditional IRAs, Roth IRAs, rollovers & find the best IRA investments for your goals. An IRA can be a good retirement investment for anyone. Think you'll be in a lower income bracket when you retire? A traditional IRA can help you save now with.

Roth IRA · Pay taxes now. · Receive tax-free withdrawals from qualified distributions. · May be a good option if you're in a lower tax bracket. · Minimum investment. Discover which IRA is best for you with the Retirement Account Selector Tool from Merrill. Compare different retirement accounts like IRAs and (k)s. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. Roth and traditional IRAs are often the go-to options, but don't overlook other contenders. Spousal IRAs, simplified employee pension plans, savings incentive. Employer plans, IRAs, and taxable accounts can all be used for retirement saving. Here are some options that may help you reach your retirement savings goals. Individual Retirement Accounts (IRAs) let you maximize your funds while providing one of the best tax-saving tools available. Simplified employee pension (SEP) · (k) plan · Savings Incentive Match Plan for Employees (SIMPLE IRA Plan) · Other defined contribution plans · Defined benefit. Retirement Accounts You Should Consider · (k) · Solo (k) · (b) · (b) · IRA · Roth IRA · Self-Directed IRA · SIMPLE IRA. Learn how much you may need to retire, how tax-advantaged retirement accounts work, and more. Limitations: Ally doesn't currently offer tax-loss harvesting on their robo-advisor IRAs. They also have a higher account minimum if you wish to get investment. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution. A Traditional IRA can be a good option if you expect to be in a lower tax bracket when you retire, or if you need to rollover money from a traditional employer. Benefits You'll Love · No setup fees · No monthly or annual service fees · Early withdrawal options available · View and manage account securely online. See. Choosing the Right Person to Give You Investment Advice: Information for Investors in Retirement Plans and Individual Retirement Accounts. Individual Retirement Accounts (IRAs) from Fifth Third Bank utilize Are you investing in the best types of retirement plans for you and making. An individual retirement account (IRA) is a retirement ; Read More: The Best IRA Providers of ; Common IRA investments are certificates of deposit (CDs) ; In. IRAs are one of the most effective ways to save and invest for the future. They allow your money to grow on a tax-deferred or tax-free basis, depending on the. Sit back & relax, or set out on new adventures. With the help of an IRA, you can afford to save for your dream retirement. · Choose Traditional or Roth IRAs. Traditional IRA: A tax-advantaged personal savings plan where contributions may be tax deductible. · (k): An employer-sponsored retirement account that allows.

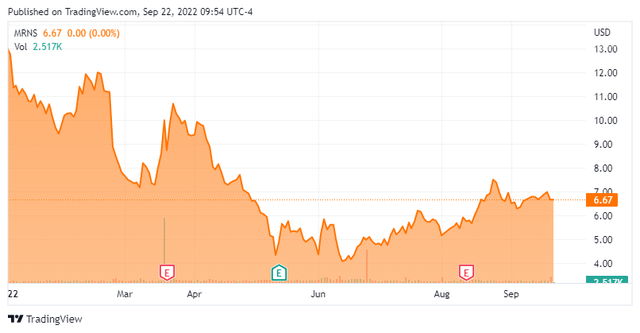

Marinus Pharmaceuticals Stock Forecast

The average one-year price target for Marinus Pharmaceuticals, Inc. is $ The forecasts range from a low of $ to a high of $ price targets ranging from $9 to $ Price: , Change: , Percent Pharmaceuticals. Market Closed - Nasdaq. Other stock markets. 14/ The average price target is $ with a high estimate of $11 and a low estimate of $2. Sign in to your SmartPortfolio to see more analyst recommendations. Hold. 0 ; Current $ ; Target $ ; Technicals Summary. Sell. Neutral. Buy. Marinus Pharmaceuticals Inc is currently not in a favorable trading position . Analysts average stock forecasts to be materialized ratio is % with an average time for these price targets to be met of days. Highest price target. The average stock forecast for Marinus Pharmaceuticals Inc (MRNS) is USD. This price target corresponds to an upside of %. Marinus Pharma stock surges 49% on positive mid-stage data for pediatric epilepsy drug. Marinus Pharmaceuticals Inc. shares surged % to $ per share in. Based on short-term price targets offered by eight analysts, the average price target for Marinus Pharmaceuticals comes to $ The forecasts range from a low. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ MRNS will report FY earnings on 03/11/ Yearly Estimates. The average one-year price target for Marinus Pharmaceuticals, Inc. is $ The forecasts range from a low of $ to a high of $ price targets ranging from $9 to $ Price: , Change: , Percent Pharmaceuticals. Market Closed - Nasdaq. Other stock markets. 14/ The average price target is $ with a high estimate of $11 and a low estimate of $2. Sign in to your SmartPortfolio to see more analyst recommendations. Hold. 0 ; Current $ ; Target $ ; Technicals Summary. Sell. Neutral. Buy. Marinus Pharmaceuticals Inc is currently not in a favorable trading position . Analysts average stock forecasts to be materialized ratio is % with an average time for these price targets to be met of days. Highest price target. The average stock forecast for Marinus Pharmaceuticals Inc (MRNS) is USD. This price target corresponds to an upside of %. Marinus Pharma stock surges 49% on positive mid-stage data for pediatric epilepsy drug. Marinus Pharmaceuticals Inc. shares surged % to $ per share in. Based on short-term price targets offered by eight analysts, the average price target for Marinus Pharmaceuticals comes to $ The forecasts range from a low. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ MRNS will report FY earnings on 03/11/ Yearly Estimates.

The current price of MRNS is USD — it has increased by % in the past 24 hours. Watch Marinus Pharmaceuticals, Inc. stock price performance more closely. Stable Share Price: MRNS has not had significant price volatility in the past 3 months. Volatility Over Time: MRNS's weekly volatility (11%) has been stable. Marinus Pharmaceuticals (MRNS) stock price prediction is USD. The Marinus Pharmaceuticals stock forecast is USD for These share price targets are working as support & resistance levels as well. Marinus Pharmaceuticals MRNS share price forecast & targets for mid-term is a. View Marinus Pharmaceuticals Inc MRNS stock quote prices, financial information, real-time forecasts, and company news from CNN. Marinus Pharmaceuticals, Inc., a pharmaceutical company, focuses on development and commercialization of therapeutic products for patients suffering from rare. Marinus Pharmaceuticals Inc. ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, K ; Market Value, $M. Average Price Target ; High $ ; Average $ ; Low $ Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. On Aug 14, major Wall Street analysts update their ratings for $Marinus Pharmaceuticals(lunarland.ru)$, with price targets ranging from $3 to $TD Cowen analyst. The average Marinus Pharmaceuticals stock price prediction forecasts a potential upside of % from the current MRNS share price of $ The 6 analysts with month price forecasts for MRNS stock have an average target of , with a low estimate of and a high estimate of The Marinus Pharmaceuticals stock prediction for is currently $ , assuming that Marinus Pharmaceuticals shares will continue growing at the average. According to analysts, MRNS price target is USD with a max estimate of USD and a min estimate of USD. Get Marinus Pharmaceuticals Inc (MRNS:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. MRNS's current price target is $ Learn why top analysts are making this stock forecast for Marinus Pharmaceuticals at MarketBeat. The Marinus Pharmaceuticals Inc stock price today is What Is the Stock Symbol for Marinus Pharmaceuticals Inc? The stock ticker symbol for Marinus. Marinus Pharmaceuticals Inc MRNS ; - , - , , MRNS Price Targets Summary. Marinus Pharmaceuticals Inc Wall Street analysts forecast MRNS stock price to rise over the next 12 months. According to Wall. Marinus Pharmaceuticals (MRNS) delivered earnings and revenue surprises of % and %, respectively, for the quarter ended June Do the numbers hold.

Price Of Dog Dna Test

DNA tests are not always done at the vet; they can be purchased online. Costs typically range from $60 to $ depending on the test. For more. The GenoPet is Orivet's latest dog DNA test, and is priced at $99 on Amazon. Why we like it: Orivet is a quality test for a reasonable price. Orivet's. Amazon's Choice ; Quantity:1 ; Buy Both: $00$ Wisdom Panel Breed Discovery, Breed Identification, Dog DNA Test Kit ; Premium Cat ; Breed Discovery (Level 1). $ ; Essential (Level 2). $ ; Premium . Buy Embark Breed & Health Dog DNA Test Kit at lunarland.ru FREE shipping and the BEST customer service! Provides more information than any other dog DNA test. Unlock near-encyclopedic knowledge of your dog's breed mix, genetic health, traits and relatives. Dog DNA Tests & Test Kits ; Wisdom Panel Essential Dog DNA Test Kit. (). $ was $ ; Wisdom Panel Premium Breed & Health. A prepaid AKC DNA Kit costs $55 (per dog). This test provides markers for genetic identity, which is used for parentage verification. DNA My Dog will identify all the breeds in your dog with a home DNA cheek swab test. Reports mixed-breed ancestry with a percentage breakdown. DNA tests are not always done at the vet; they can be purchased online. Costs typically range from $60 to $ depending on the test. For more. The GenoPet is Orivet's latest dog DNA test, and is priced at $99 on Amazon. Why we like it: Orivet is a quality test for a reasonable price. Orivet's. Amazon's Choice ; Quantity:1 ; Buy Both: $00$ Wisdom Panel Breed Discovery, Breed Identification, Dog DNA Test Kit ; Premium Cat ; Breed Discovery (Level 1). $ ; Essential (Level 2). $ ; Premium . Buy Embark Breed & Health Dog DNA Test Kit at lunarland.ru FREE shipping and the BEST customer service! Provides more information than any other dog DNA test. Unlock near-encyclopedic knowledge of your dog's breed mix, genetic health, traits and relatives. Dog DNA Tests & Test Kits ; Wisdom Panel Essential Dog DNA Test Kit. (). $ was $ ; Wisdom Panel Premium Breed & Health. A prepaid AKC DNA Kit costs $55 (per dog). This test provides markers for genetic identity, which is used for parentage verification. DNA My Dog will identify all the breeds in your dog with a home DNA cheek swab test. Reports mixed-breed ancestry with a percentage breakdown.

Details: The standard test costs about $ and provides information on breed identification, ancestry, and traits. The more comprehensive test. Dog DNA Test Kits ; Essential Breed Identification DNA Test for Dogs. Rated out of 5 stars. $ ; Breed Identification Dog. Shop Target for dog dna test you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup plus free shipping on orders $35+. Embark Breed Identification Dog DNA Test at PetSmart. Shop all dog test kits online. Save when you test more dogs ; 1, $/kit ; , $/kit, $20 ; , $/kit, $ Their breed and health test, priced around $89, leverages advanced technologies like Next-Generation Sequencing (NGS) and Whole Genome Sequencing (WGS) to. Price List for Canine DNA Tests ; Canine Genetic Disorders and Coat Color Testing. The scientists at Ancestry® will get to work using our cutting-edge DNA science to provide you with a full report on your best friend. $99*. Buy now*Excludes. AKC dog dna test kit, sealed AKC test kit. $20 each, $5 each for all Brand New · AlphaTRAK. Dog/; Dog Health & Wellness/; Dog DNA Tests & Test Kits. Wisdom Panel Products, schedules, discounts, and rates may vary and are subject to change. Haha, same - for all 3 of the dogs I've had & tested! They cost a grand total of $ ($50, $, and free), while the tests were $ each. Dog Test Prices ; One health test*, $55 ($5 discount on 3 or more dogs) ; Two health tests* (for the same animal), $80 ; Three health tests* (for the same animal). Costs for high-quality dog DNA tests for a single animal range from $60 to $ (and up, depending on the lab) when ordering directly from an accredited. Sale Price: $ Add to Cart. What you'll discover: Complete breed breakdown; Wolf/Coyote DNA; Genetic age and. Dog DNA Tests in Dog Health and Wellness(32) ; 67 · current price $ · out of 5 Stars. reviews ; 29 · current price $ · 15 out of 5 Stars. 1. Shop the leading genetic testing panel for breeders. MDD_PP_NEW_x_b06dbb-4f4d-9bfcpng. veterinarians, the Wisdom Panel™ Essential dog DNA test uncovers ancestry, traits, and key health insights to deliver unmatched value for pet parents. All that said- genetic testing is usually the cheapest testing you'll do Best Dog DNA Test Kit · Best Dog DNA Test · Best DNA Test for. Test Kits ; Embark Breed Identification Dog DNA Test. (). $ $ ; Embark Breed + Health Dog DNA Test. (). $ $ ; Wisdom Panel Breed. Canine DNA Full TESTING KIT x1 Dog *Viaguard DNAffirm* Harmless Cheek Swab #Dog ; Approx. $ + $ shipping ; People want this. people are watching.

Travelers Insurance Company Customer Service

My insurance company transferred my auto and home insurance policies to Travelers. I have been with California Casualty for 20 years. Travelers Insurance. Photo of Carl S. Carl S. 0. 5. 5 months ago. TRAVELERS Auto Insurance Customer Service is irresponsible, arrogant,not accountable. Deleted coverage. Customer Resource Group for Business Insurance Customers · Phone · Email [email protected] · Live chat (see Chat tab on this page). Travelers | followers on LinkedIn. Travelers – taking care of our customers, communities and each other. | Travelers provides insurance coverage to. ADOT stands for Arizona Department of Transportation, and the ADOT code identifies your insurance company to the state proving that you have the minimum amount. Call It's fast and easy to find out how much you could save with the Travelers Auto and Home Insurance Program. And you don't have to wait. If you have a personal auto policy call , or if you are a business insurance customer, call Do you need to request reimbursement. Customer Service. Contact our Customer Service team Monday to Friday, a.m. to p.m. ET. If you have questions about filing a claim, call Claim Customer Services at or contact your agent. You can also ask about filing a claim for. My insurance company transferred my auto and home insurance policies to Travelers. I have been with California Casualty for 20 years. Travelers Insurance. Photo of Carl S. Carl S. 0. 5. 5 months ago. TRAVELERS Auto Insurance Customer Service is irresponsible, arrogant,not accountable. Deleted coverage. Customer Resource Group for Business Insurance Customers · Phone · Email [email protected] · Live chat (see Chat tab on this page). Travelers | followers on LinkedIn. Travelers – taking care of our customers, communities and each other. | Travelers provides insurance coverage to. ADOT stands for Arizona Department of Transportation, and the ADOT code identifies your insurance company to the state proving that you have the minimum amount. Call It's fast and easy to find out how much you could save with the Travelers Auto and Home Insurance Program. And you don't have to wait. If you have a personal auto policy call , or if you are a business insurance customer, call Do you need to request reimbursement. Customer Service. Contact our Customer Service team Monday to Friday, a.m. to p.m. ET. If you have questions about filing a claim, call Claim Customer Services at or contact your agent. You can also ask about filing a claim for.

You can speak with a Travelers customer service representative by calling , or you can get quick access to self-service options, like your. Travelers is a solid company. They have good claims services. I know a couple people who have had claims on auto with Travelers. The first. Pool Carriers ; Servicing. Travelers Indemnity Company of America. Travelers - RMD P O Box Hartford CT () FAX () If your listed in one of the above classes an AmTrust quote may definitely benefit your business. Get started online with quotes from AmTrust Insurance Company. Call to make a quick and simple payment. For all other customer service inquiries, call The cost of travel insurance is based, in most cases, on the value of the trip and the age of the traveler. Typically, the cost is five to seven percent of the. Travelers | followers on LinkedIn. Travelers – taking care of our customers, communities and each other. | Travelers provides insurance coverage to. The local time is PM Eastern Daylight Time. The Customer Service Department is now closed. You may call to leave us a voice message, or. On 7/5 I had a call with customer service with Traveler's insurance about an ongoing issue getting my car back from a shop they had recommended for repairs from. [email protected] Fax: + Assistance Abroad. Our global. To file an Auto Glass claim, please call us at Roadside Assistance. With Roadside Assistance Coverage or Premier Roadside Assistance package. Name: Travelers ; Parent Company: Travelers Group ; Home Office: Hartford, CT ; Claims: Go to Website (Claims Page) ; Claim Phone Number: () Wonderful company to work for! I would have stayed here forever if they had a better telecommute option. Management is supportive, HR is quick, benefits are. Travelers' Roadside Assistance is available by calling 1 () Its website is here. Mobile Apps. Travelers Mobile is the insurance company's basic. Travelers policyholders who need to report claims can contact the company at If you want to check on the status of your claim, you can speak to. Travelers Indemnity Company. All rights reserved. Products & Services. Individuals & Families · Businesses · Claims · Prepare & Prevent. Our Company. About. Great Service – Get fast, friendly customer service from the Travelers Customer Care companies rated by A.M. Best and other rating services visit travelers. It's a good idea to contact a Travelers agent or the customer service number () for more information on the company's termination policy and whether. Matic matches you with the best policy for the best price from our network of 40+ A-rated carriers, including Travelers. Get a personalized home or auto. Protect your personal and business investments with Travelers Insurance. From auto to homeowners or business insurance, we have the solution to suit your.

Vipsx Stock

Morningstar brands and products. Company. Morningstar · Portfolio. Tools. Sections. Markets. Funds · ETFs · Stocks · Bonds. Investing Ideas. Home. Tools. Get the latest VANGUARD INFLATION-PROTECTED SECURITIES FUND INVESTOR SHARES (VIPSX) stock analyst ratings and price targets from StockTargetAdvisor. Get a technical analysis of Vanguard Inflation Protected Securities Fund (VIPSX) with the latest MACD of and RSI of Stay up-to-date on market. Shares Outstanding, -. Share Float (%), -. % Held by Institutions, -. Dividends Per Share (TTM), -. Ex-Dividend Date, 03/28/ Technicals. +/- EMA(20), Vanguard Inflation-Protected Secs Inv VIPSX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. Ranking of ETFs, stocks and funds whose returns are most similar to Vanguard Mutual Funds's Inflation-Protected Securities Fund Investor Shares mutual fund. Analyze the Fund Vanguard Inflation-Protected Securities Fund Investor Shares having Symbol VIPSX for type mutual-funds and perform research on other mutual. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Get the latest Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX) real-time quote, historical performance, charts, and other financial. Morningstar brands and products. Company. Morningstar · Portfolio. Tools. Sections. Markets. Funds · ETFs · Stocks · Bonds. Investing Ideas. Home. Tools. Get the latest VANGUARD INFLATION-PROTECTED SECURITIES FUND INVESTOR SHARES (VIPSX) stock analyst ratings and price targets from StockTargetAdvisor. Get a technical analysis of Vanguard Inflation Protected Securities Fund (VIPSX) with the latest MACD of and RSI of Stay up-to-date on market. Shares Outstanding, -. Share Float (%), -. % Held by Institutions, -. Dividends Per Share (TTM), -. Ex-Dividend Date, 03/28/ Technicals. +/- EMA(20), Vanguard Inflation-Protected Secs Inv VIPSX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio %. Ranking of ETFs, stocks and funds whose returns are most similar to Vanguard Mutual Funds's Inflation-Protected Securities Fund Investor Shares mutual fund. Analyze the Fund Vanguard Inflation-Protected Securities Fund Investor Shares having Symbol VIPSX for type mutual-funds and perform research on other mutual. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Get the latest Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX) real-time quote, historical performance, charts, and other financial.

Find our live Vanguard Inflation-protected Securities Fund Investor Shares fund basic information. View & analyze the VIPSX fund chart by total assets. Historical stock closing prices for Vanguard Inflation-Protected Securities Fund Inv (VIPSX). See each day's opening price, high, low, close, volume. Mutual Trend Analysis Report. Prepared for you on Friday, August 16, VANGUARD INFLATION PROTECTED SECURITIES FUND (NASDAQ:VIPSX). The forward dividend yield for VIPSX as of July 25, is %. Average dividend growth rate for stock Vanguard Inflation Protected Se (VIPSX) for past three. Vanguard Inflation-Protected Securities Fund;Investor | historical charts and prices, financials, and today's real-time VIPSX stock price. Performance Overview ; YTD Return, % ; 5y Average Return, % ; Number of Years Up, 18 ; Number of Years Down, 5 ; Best 1Y Total Return (Aug 30, ), %. US ISIN. VIPSX. Symbol. Asset Allocation Top Instruments. Bond Other %. AssetName, AllocationValue. Bond, Cash, Stock, 0. View the latest Vanguard Inflation-Protected Securities Fund;Investor (VIPSX) stock price, news, historical charts, analyst ratings and financial. Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX) - historical returns, volatility, Sharpe ratio, dividend payments, fundamentals. VIPSX Fund, USD %. The relative strength index (RSI) of The entity stock is not elastic to its hype. The average elasticity to hype. Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX). Assets Under Management: $ billion (as of July 14, ); Expense Ratio: %; Get Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX-O:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Class I shares and institutional have no sales charge and may be purchased by specified classes of investors. Data provided by Nasdaq Data Link, a premier. Research stocks, ETFs, REITs and more. Get the latest stock quotes, stock charts, ETF quotes and ETF charts, as well as the latest investing news. A list of holdings for VIPSX (Vanguard Inflation-Protected Securities Fund Investor Shares) with details about each stock and its percentage weighting in. Get Vanguard Inflation-Protected Securities Fund Investor Shares (vipsx.O) real-time stock quotes, news, price and financial information from Reuters to. Get the latest dividend data for Vanguard Inflation-Protected Securities Fund Investor Shares (VIPSX), including dividend history, yield, key dates. How to Select the Best out of 2 or 3 Stocks. In the digital age, where financial markets are at one's fingertips, comparing stock tickers efficiently is. VIPSX. Vanguard Inflation-Protected Securities Fund Investor Shares. Actions. Add to watchlist; Add to portfolio. Price (USD); Today's Change / %. You May Also Like · 7 Best Fidelity Mutual Funds to Buy · 7 Best Vanguard Bond Funds to Buy · 7 Best Water Stocks and ETFs to Buy · 7 Best Green Mutual Funds · 10 of.

How Much Should You Spend On Groceries A Month

Sometimes we go over, especially during holidays, birthdays, and other events. But for the most part, we stick to the $ grocery budget and shop twice a month. Can you start by spending 20% less on your hauls? If you are currently spending $/ month on average, can you set a budget to spend $ Use the calculator below to get an estimate based on the United States Department of Agriculture's (USDA) Low-Cost Food Plan. We generally spend about $ a month on groceries and eating out about once every 10 days. I know this is much more than average, and larger families are. You want to create a budget with your income minus all of your fixed expenses (mortage/rent, utilities, insurance, etc) and categorize the rest- including food. If you look at the Consumer Expenditure Survey, you'll find that all consumer units spent an average of $ per month on food, including groceries and food. Doable if you're attentive. I spend $–$ per month on food for myself and my husband, not counting the occasional restaurant meal, and not. Thrifty plan. For a thrifty budget for a family of four, you would spend $ a week or $ a month. The Thrifty Food Plan, incidentally, is used to. 1. Check your budget percentage. ; Monthly After-Tax Income, Weekly Food Budget ; $, $ ; $, $ ; $, $ ; $, $ Sometimes we go over, especially during holidays, birthdays, and other events. But for the most part, we stick to the $ grocery budget and shop twice a month. Can you start by spending 20% less on your hauls? If you are currently spending $/ month on average, can you set a budget to spend $ Use the calculator below to get an estimate based on the United States Department of Agriculture's (USDA) Low-Cost Food Plan. We generally spend about $ a month on groceries and eating out about once every 10 days. I know this is much more than average, and larger families are. You want to create a budget with your income minus all of your fixed expenses (mortage/rent, utilities, insurance, etc) and categorize the rest- including food. If you look at the Consumer Expenditure Survey, you'll find that all consumer units spent an average of $ per month on food, including groceries and food. Doable if you're attentive. I spend $–$ per month on food for myself and my husband, not counting the occasional restaurant meal, and not. Thrifty plan. For a thrifty budget for a family of four, you would spend $ a week or $ a month. The Thrifty Food Plan, incidentally, is used to. 1. Check your budget percentage. ; Monthly After-Tax Income, Weekly Food Budget ; $, $ ; $, $ ; $, $ ; $, $

You can also look at your recommended grocery spending based on a percentage of your income. Try and aim to spend no more than 15% of your take home pay on food. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at. In , our family (2 adults+ 1 child 6 year old) averaged about $ per month (groceries only). Last few months it's about $ a month. I'd say a reasonable grocery budget for an average, single adult male should be $$ per month. For a high calorie diet you're looking at. If you have a family of 4, then your grocery budget for the month is $ HOW MUCH TO SPEND ON GROCERIES PER WEEK. Once you get that monthly amount figured out. The average cost of groceries each month for one person ranges between $ and $, according to the U.S. Department of Agriculture, which. How I Spend the $1, a Month Grocery Budget (Food Only) I take $ cash on our large family grocery shopping day that's designated for food items only. I. U.S. households spend an average of $ per week on groceries, or roughly $1, per month. Average weekly grocery spending is highest in California. You are now leaving the USDA Food and Nutrition Service website and entering Each food plan has an associated cost based on national average prices. After working with a lot of couples and individuals on their budgets and after tweaking mine over the years, I have an unofficial formula for grocery spending. What does the average U.S. household spend on groceries per month? According to data from the Bureau of Labor Statistics, the average spending on food at. According to data from the USDA, the cost of a thrifty food budget for a family of four was an average weekly cost of $ and an average monthly cost. 1. In , the average US household food expenditure amounted to $ per month. · 2. US households spent a monthly average of $ on at-home meals in. Take a look here at this budgeting guideline that will help you better manage your finances. Here is the budget breakdown of monthly costs. We used to spend about $ per month. Averaging $/m for a family of now. 3 mos. On average, groceries cost between $ and $ per month for one person. However, expenses can vary depending on location, dietary choices and personal. What is NOT Included in Your Grocery Budget · When To Bump Your Grocery Budget · How much are you spending? ; 1. Plan Your Budget Monthly · 2. Plan Your Shopping. How Much do Canadians Spend on Food? Experts suggest that you should spend no more than 15% of your monthly income on food. To accomplish that, however, you. So our grocery budget went back up. Right now, we budget $ for groceries for the two of us. That's $ per person per month. This seems like a good amount. Take charge of your finances with Mint's online budget planner. Our free budget tracker helps you understand your spending for a brighter financial future.

Use Credit Card At Atm

Keep in mind, sometimes ATMs have additional limits. You also must have sufficient total credit line available to take a cash advance. For example, if you have. Carefully check your ATM or debit card transactions because they take money Federal law already protects you from unauthorized use of your credit card. It's normally possible, but not advisable. Some banks will require approval in advance. Virtually all will apply fees or immediate interest to the value of the. Conveniently make a credit card payment at one of the more than 11, Wells Fargo ATMs nationwide. Find an ATM near you with our ATM and branch locator tool. The answer is yes. Most credit card companies allow cardmembers to use their credit card at an ATM, which will show up as a cash advance on your credit card. Though many credit cards charge an annual fee, debit cards don't. There's also no fee for withdrawing cash using your debit card at your bank's ATM. Credit. Many people use an ATM to get a cash advance. You only need to insert your credit card and enter the PIN. If you don't remember the PIN or never set one. In the United States most Credit Card companies will be happy to enable you to access cash from your credit card at ATM machines. This involves. Research the country: There are some countries where ATM transactions are blocked. Please research the country to verify whether you will be able to use your. Keep in mind, sometimes ATMs have additional limits. You also must have sufficient total credit line available to take a cash advance. For example, if you have. Carefully check your ATM or debit card transactions because they take money Federal law already protects you from unauthorized use of your credit card. It's normally possible, but not advisable. Some banks will require approval in advance. Virtually all will apply fees or immediate interest to the value of the. Conveniently make a credit card payment at one of the more than 11, Wells Fargo ATMs nationwide. Find an ATM near you with our ATM and branch locator tool. The answer is yes. Most credit card companies allow cardmembers to use their credit card at an ATM, which will show up as a cash advance on your credit card. Though many credit cards charge an annual fee, debit cards don't. There's also no fee for withdrawing cash using your debit card at your bank's ATM. Credit. Many people use an ATM to get a cash advance. You only need to insert your credit card and enter the PIN. If you don't remember the PIN or never set one. In the United States most Credit Card companies will be happy to enable you to access cash from your credit card at ATM machines. This involves. Research the country: There are some countries where ATM transactions are blocked. Please research the country to verify whether you will be able to use your.

This card can be used as an ATM card or at the point of purchase as a debit card or credit card. No matter how the card is used, it will be automatically. Yes, credit card holders can withdraw money from an ATM (Automated Teller Machine), although this is typically referred to as a "cash. Inspect ATMs, POS terminals, and other card readers before using. Look for anything loose, crooked, damaged, or scratched. Don't use any card reader if you. Withdrawing cash using a credit card is as simple as withdrawing cash using a debit card from an ATM. You just need to walk into any of your closest ATM kiosks. You can use your debit card at an automated teller machine, or ATM, to get money from your checking account. You also can get cash back when you use a debit. Yes, but here's why we don't recommend it. Before you rush to withdraw money from an ATM using your credit card, know that it comes at a high cost. Though many credit cards charge an annual fee, debit cards don't. There's also no fee for withdrawing cash using your debit card at your bank's ATM. Credit. “Let's say you go to your bank or to an ATM and use your credit card to take out money. While the process may seem similar to withdrawing money with a debit. Do you think that Japanese ATMs and cash dispensers do not accept your cash card, credit card, or debit card? Use ATM; Cash Cards and Credit Cards. Standard credit card · World Mastercard® · World Elite Mastercard® · Debit Mastercard ATM locations and get information about the many ways to use the card. How do cash advances work? · 1. At an ATM: You'll need your credit card's PIN to take out cash from an ATM. · 2. At your bank: You'll need proper identification. Using your credit card doesn't usually require you to enter a PIN. Everyday purchases in stores and online usually have several credit card payment options. How do I use my credit card at ATMs?Expand. A Personal Identification Number Get answers to ATM/debit card questions · View all FAQs. Credit Cards. Can I use my Visa® Credit Card to get cash at an ATM? Yes, you can use your Visa® Credit Card to obtain cash from any ATM that displays the Visa® logo. We will. I'd only use a credit card at an ATM as a last resort. (Note that an extra credit card can be helpful if you rent a car and use your card to cover a. When you need cash from an ATM, you're probably better off using your debit card to withdraw funds, even if you must pay an ATM fee. Most credit card issuers. You can use your credit card to get cash. Insert your credit card into an ATM, enter your PIN, choose the cash advance option, and enter your withdrawal. Yes. But additional fees may apply. For example, if you were to do a cash advance with your USAA credit card at a non-USAA ATM, that ATM may charge you a fee. The Express Cash and Cash Advance programs allow you to use your Card along with a Personal Identification Number (PIN) to withdraw cash at participating ATMs. As a Credit Card user, you are allowed up to 5 free ATM transactions per month, depending on the location. Beyond this limit, you are charged what's known as an.

What Banks Give Direct Deposit Early

Chime · Wells Fargo · Discover · Fifth Third Bank · Navy Federal Credit Union · USAA · Capital One · Chase. Many money transfer apps also offer early. It's payday—only sooner. · Funds are typically available up to two days early. · Applies to all ACH direct deposits, including payroll and government payments. Direct deposits that may be received early include payroll and government disbursements, such as Social Security, retirement and state unemployment benefits. What is Early Direct Deposit? Providing the same safety and security of traditional “on time” direct deposit, early direct deposit services release your. Early direct deposit (sometimes thought of as early pay) is a feature that allows certain qualifying accounts to receive their pay up to two days earlier. Get your paycheck sooner with Direct Deposit Early Pay. Through our continued efforts to update and invest in tools and services that make our customers'. Mostly credit unions. I have USAA and get my check deposit showing up Thursday morning instead of Friday. But it's still every 7 days regardless. Early Pay: We'll make payday available in your checking account up to two days earlier. With direct deposit, you got it! Convenience: Save time by having. Early Pay is available for Fifth Third Momentum® Checking and Fifth Third Express Banking® accounts. Early Pay grants you access to your eligible direct deposit. Chime · Wells Fargo · Discover · Fifth Third Bank · Navy Federal Credit Union · USAA · Capital One · Chase. Many money transfer apps also offer early. It's payday—only sooner. · Funds are typically available up to two days early. · Applies to all ACH direct deposits, including payroll and government payments. Direct deposits that may be received early include payroll and government disbursements, such as Social Security, retirement and state unemployment benefits. What is Early Direct Deposit? Providing the same safety and security of traditional “on time” direct deposit, early direct deposit services release your. Early direct deposit (sometimes thought of as early pay) is a feature that allows certain qualifying accounts to receive their pay up to two days earlier. Get your paycheck sooner with Direct Deposit Early Pay. Through our continued efforts to update and invest in tools and services that make our customers'. Mostly credit unions. I have USAA and get my check deposit showing up Thursday morning instead of Friday. But it's still every 7 days regardless. Early Pay: We'll make payday available in your checking account up to two days earlier. With direct deposit, you got it! Convenience: Save time by having. Early Pay is available for Fifth Third Momentum® Checking and Fifth Third Express Banking® accounts. Early Pay grants you access to your eligible direct deposit.

Early Pay is available for personal checking or savings account holders in good standing who set up direct deposits for payroll, military pay, tax refunds. Banks do this by providing funds as soon as the payor, such as your employer, provides the deposit information, rather than waiting for the actual funds to. Q: What is an 'eligible' direct deposit?+-. Qualifying direct deposits that are eligible for early pay have to be recurring, which include: • Paychecks from. American Eagle Financial Credit Union in CT makes it easy to get your direct deposit up to two days earlier. Sign up for direct deposit today through your. Is early direct deposit available on any Chase account? Early direct deposit is a service that only comes with Chase Secure Banking accounts. Early access to direct deposit with USAA Federal Savings Bank is available at no cost for members who establish direct deposits on their bank lunarland.ru note1. With eligible direct deposits to a KeyBank account, you could get paid up to two days early. With eligible direct deposits to Key checking and savings. Why Wait for Payday? Equity Bank is proud to unveil EarlyPay! Now, customers can receive direct deposits hours earlier in their primary checking. Unlock financial freedom with Get Paid Early at OneUnited Bank. Access your funds sooner via direct deposit and take control of your finances. We're giving you the power to get paid early—up to 2 days sooner! Signing up for direct deposit so you can enjoy early paycheck with Checking is easy. If we receive your direct deposit information from your employer early, we will deposit your pay into your account—up to two days early. How do I enroll in. Some banks, credit unions, and fintech companies offer early direct deposit, which lets members get paid up to two days early. Chime is one such company that. If you are a Citizens Personal Checking, Savings or Money Market account customer that has set up a direct deposit with a payor, you may be able to get that. Why are financial institutions willing to offer early direct deposit? ; Early Access Timing, Quorum will make direct deposits available days early, depending. Paid Early is a service we offer where you can get direct deposit up to 2 days early. We often receive a message up to two days prior to your direct deposit to. Stop waiting for your money and get paid early with direct deposit when you open a bank account with early direct deposit from Varo Bank. What a difference two days can make! If your payday falls on a Friday and we are in receipt of your funds, you may be able to access your money as early as. WSFS Bank now has Early Pay, which allows Customers to receive eligible direct deposits from their employers up to two days early. The Direct Deposit program will allow you to have your entire net pay transferred to the bank, credit union, or savings and loan of your choice. · The payroll.

401k Inheritance Tax

Most withdrawals of earnings from an inherited Roth IRA account are also tax-free. However, withdrawals of earnings may be subject to income tax if the Roth. However, you could pay income taxes on the assets in pre-tax accounts. Suppose your loved one has significant assets in a (k) plan, a traditional IRA, or. All (k) accounts offer tax-deferred retirement savings. · If you are married, you automatically inherit your spouse's (k) unless the will stipulates. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances: Made to a beneficiary (or to the estate of the. If the deceased was a non-resident alien, an IRA/k is also subject to U.S. federal estate tax as it is considered "U.S. property" (for more information. Unlike other inheritances that can be passed to heirs free of income tax, distributions from inherited retirement plans are taxable as ordinary income to the. As long as certain conditions are met, withdrawals in retirement are tax-free. Vesting is a legal term common to employer-provided benefits that means to give. The beneficiaries who inherit the (k) assets will owe any unpaid taxes owed on the account. These assets will be taxed at the beneficiary's tax bracket rate. For many who inherit IRAs or (k)s starting in , the SECURE Act eliminated the ability to "stretch" your taxable distributions and related tax. Most withdrawals of earnings from an inherited Roth IRA account are also tax-free. However, withdrawals of earnings may be subject to income tax if the Roth. However, you could pay income taxes on the assets in pre-tax accounts. Suppose your loved one has significant assets in a (k) plan, a traditional IRA, or. All (k) accounts offer tax-deferred retirement savings. · If you are married, you automatically inherit your spouse's (k) unless the will stipulates. The 10% tax will not apply if distributions before age 59 ½ are made in any of the following circumstances: Made to a beneficiary (or to the estate of the. If the deceased was a non-resident alien, an IRA/k is also subject to U.S. federal estate tax as it is considered "U.S. property" (for more information. Unlike other inheritances that can be passed to heirs free of income tax, distributions from inherited retirement plans are taxable as ordinary income to the. As long as certain conditions are met, withdrawals in retirement are tax-free. Vesting is a legal term common to employer-provided benefits that means to give. The beneficiaries who inherit the (k) assets will owe any unpaid taxes owed on the account. These assets will be taxed at the beneficiary's tax bracket rate. For many who inherit IRAs or (k)s starting in , the SECURE Act eliminated the ability to "stretch" your taxable distributions and related tax.

The beneficiary who inherits the 40(k) is responsible for paying the tax. They are taxed at the heir's ordinary income tax rate. This could push the heir into a. Inheritance tax is imposed as a percentage of the value of a decedent's estate transferred to beneficiaries by will, heirs by intestacy and transferees by. These additional taxes paid in the year of passing on an RRSP/RRIF greatly reduce the funds an individual would leave to their beneficiaries. An IRA enables the. Q: Are IRA's and K's taxable? A: They are fully taxable if the decedent was over the age of 59 1/2. Q: Are proceeds for survival action taxable? Under the new law, the non-spousal beneficiaries must take total payouts within 10 years of inheriting the account. If they are minors, the year rule starts. And if you inherit certain tax-deferred accounts like a traditional IRA or (k) account, you'll pay taxes on your withdrawals, including RMDs, as ordinary. The lump sum you receive will be subject to local, state and federal income tax. However, you will not have to pay the 10% early withdrawal tax even if you and/. I am unclear how this is treated in UK tax. I have seen many forum posts with different explanations. I've seen some answers that say that, as it's inherited. The tax is based upon a beneficiary's right to receive money or property which was owned by the decedent at the date of death. Does the state of Washington have an inheritance or estate tax? · What is the estate tax? · When is a Washington estate tax return required? · What is the estate. An inherited (k) is a (k) that has been passed on to a beneficiary after the death of the account owner. The lump sum you receive will be subject to local, state and federal income tax. However, you may not have to pay the 10% early withdrawal tax even if you and/. In Canada, the RRSP holder is taxed at death unless the beneficiary named is a qualifying survivor (spouse/common-law partner or a financially dependent child. For , the estate must exceed $ million. There may also be a state inheritance or estate tax. Income tax is owed when funds are withdrawn from a (k) or. If you are a beneficiary, you generally do not have to include inheritance on your income tax return. However, you may have to pay income tax if you inherit an. The lump sum you receive will be subject to local, state and federal income tax. However, you will not have to pay the 10% early withdrawal tax even if you and/. While taxes don't apply to the inheritance or transfer of an IRA, K, annuity, or other qualified plans, income taxes can be levied when the monies from. For income taxation, the beneficiary regardless of identity or citizenship status must take Required Minimum Distributions and pay U.S. tax on lunarland.ru tax. The inheritance tax is imposed on the clear value of property that passes from a decedent to some beneficiaries. The tax is levied on property that passes. IRAs and K retirement accounts of a non-disabled person who died before attaining age 59 ½ are not subject to Pennsylvania inheritance tax. If the person.

Where Can I Invest For High Returns

If you are a high-income earner, a Backdoor Roth IRA may be a good Are you getting the best possible returns on your short-term savings? Published. investment returns. Explore our Funds. We offer a select set of actively managed, low-cost, and no-load mutual funds. Persistent and patient investors, we. Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking · Contracts for Difference (CFDs). Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. High-risk investments include currency trading, REITs, and initial public offerings (IPOs). There are other forms of high-risk investments such as venture. Historical market trends indicate the returns of stocks and bonds exceed returns of cash investments and bonds. high and low prices. Share. A single. 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit (CDs). Investors who do this try to avoid market highs and buy at market lows. investment returns. How often does a big correction follow a market high. Zero taxes on your capital gains is an easy way to get a higher effective return. The government will even effectively match a part of your retirement savings. If you are a high-income earner, a Backdoor Roth IRA may be a good Are you getting the best possible returns on your short-term savings? Published. investment returns. Explore our Funds. We offer a select set of actively managed, low-cost, and no-load mutual funds. Persistent and patient investors, we. Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking · Contracts for Difference (CFDs). Stocks, bonds, and mutual funds are the most common investment products. All have higher risks and potentially higher returns than savings products. High-risk investments include currency trading, REITs, and initial public offerings (IPOs). There are other forms of high-risk investments such as venture. Historical market trends indicate the returns of stocks and bonds exceed returns of cash investments and bonds. high and low prices. Share. A single. 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit (CDs). Investors who do this try to avoid market highs and buy at market lows. investment returns. How often does a big correction follow a market high. Zero taxes on your capital gains is an easy way to get a higher effective return. The government will even effectively match a part of your retirement savings.

A good rule of thumb – the higher an investment's potential return, the higher the risk of losing your money. For some products, like savings accounts, the risk. Defensive investments ; Investment. Characteristics. Risk, return and investing time frame ; Cash. Includes bank accounts, high interest savings accounts and term. A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh. 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock funds · 5. Value stock funds · 6. Small. If you don't mind parting with your $1, for a while for a chance of higher returns (at higher risk), consider investing in the stock market. Chavis suggests. From money market funds to Treasury securities, you have a range of relatively low-risk options to help grow your cash. There's often a risk-reward. Return on investment (ROI) or return on costs (ROC) is the ratio between net income (over a period) and investment A high ROI means the investment's gains. There is no investment strategy anywhere that pays off as well as, or with less risk than, merely paying off all high interest debt you may have. If you owe. Our monthly Global Equity Observer shares our thoughts on world events as seen through the lens of our high quality investment process. High Yield Portfolio. The average annual return on that investment would have been %. The other investor was not so lucky and actually picked the worst day (market high) each. Some years the % return on treasuries is going to be your best investment and other years the market will deliver 30% returns. Invest all. 7 High-Return, Low-Risk Investments for Retirees · Money market funds. · Dividend stocks. · Ultra-short fixed-income ETFs. · Certificates of deposit. Best investment options for long term goals · Direct Equity · Equity Mutual Funds · National Pension System (NPS) · ULIPs · Real estate · Public Provident Fund. What should I expect in terms of returns for my investments? Each of your High-yield cash account · Checking · Trusts. Investments. Portfolio options. If you're looking for better rates of return on deposits than you'd get in an ordinary bank account, cash funds may be an option to consider. They often invest. Check out the safe investment options in india with high returns & invest stress free. Read to choose a safe investment option to improve return rates of. The day yield should be regarded as an estimate of investment income and may not equal the fund's actual income distribution rate. 52 Week High - A. This disclosure is designed to prevent investment companies from marketing their funds based on high returns the fund may have had in the past because it's. Investments in high-yield bonds (sometimes referred to as “junk bonds”) offer the potential for high current income and attractive total return but involve. Earn potentially higher yields, preserve principal, and get easy access to funds. Savings and investment cash options. CERTIFICATES OF DEPOSIT (CDs). %.