lunarland.ru Market

Market

How To Save Extra Money Each Month

Do activities like going on walks, movie night, board games, free museums. And if you use up any leftover food from the week as well, this can all really make. This is a great way to keep track of your grocery and “other” budgets! Save every receipt that you have from the month, such as groceries, restaurants, Target. The general guideline is to accumulate three to six months' worth of household expenses. Consider putting it in a high yield savings or money market account. Use everything you have. Make a goal of cooking everything you've purchased by the end of the week, and don't buy more groceries if you still have fresh produce. By making an extra $ payment each month, you can pay off the loan in just over 4 years and save approximately $ in interest. 2. Interest Savings: Making. Your budget will calculate how much you should save each month to hit your target. Step Three: When extra money comes in, assign dollars to your savings. You may decide to treat yourself with a small part of it, but use the rest to pay down debt, boost your investments or simply keep saving. Being thoughtful with. To learn more about investing, budgeting, and your credit health, read more at our Equifax Personal Finance Center. Find financial tips and advice here. Save for "Bucket List" Items. Create a savings bucket for large purchases, like a couch, or even a vacation to Europe. Slowly put money away each month for. Do activities like going on walks, movie night, board games, free museums. And if you use up any leftover food from the week as well, this can all really make. This is a great way to keep track of your grocery and “other” budgets! Save every receipt that you have from the month, such as groceries, restaurants, Target. The general guideline is to accumulate three to six months' worth of household expenses. Consider putting it in a high yield savings or money market account. Use everything you have. Make a goal of cooking everything you've purchased by the end of the week, and don't buy more groceries if you still have fresh produce. By making an extra $ payment each month, you can pay off the loan in just over 4 years and save approximately $ in interest. 2. Interest Savings: Making. Your budget will calculate how much you should save each month to hit your target. Step Three: When extra money comes in, assign dollars to your savings. You may decide to treat yourself with a small part of it, but use the rest to pay down debt, boost your investments or simply keep saving. Being thoughtful with. To learn more about investing, budgeting, and your credit health, read more at our Equifax Personal Finance Center. Find financial tips and advice here. Save for "Bucket List" Items. Create a savings bucket for large purchases, like a couch, or even a vacation to Europe. Slowly put money away each month for.

How to save tons of money every month · Subscription hopping — Switch from one streaming service to another month by month. · Make a meal plan — Create a weekly. This means treating your savings like any other bill and earmarking a certain percentage of every paycheck to go into it. To avoid the temptation of simply. The 50 30 20 rule is a simple budgeting method, which you can use to plan out how much you should spend and save each month. A good way to keep it simple is to consider using a percentage-based budget that divides up your monthly after-tax income into categories. One of the most. Pay off credit cards in full each month. The miles and cash-back are only valuable if you're not falling into debt or paying interest. "If you're single with no dependents and a stable job, 3 months of savings may be enough," says Padamsee. "But it's smart to have 6 or even 9 months of savings. Curbing mindless spending isn't just about cutting out late-night Amazon purchases and impulse grocery buys. You probably have monthly subscriptions and. Put your spare change to work: There are apps that will take spare change on any amounts paid on a debit card and put them into savings accounts or even invest. Keep track of your expenses and income, and create a plan to improve your spending habits each month. The 50/30/20 rule is a popular budget method to follow. Your best bet is in an online high-yield savings account, which pays more interest than a traditional savings account at your local brick-and-mortar bank. You save even more money if you leave the credit cards at home and only pay with cash. Studies show that we tend to spend 15% more when we pay for things with. Curbing mindless spending isn't just about cutting out late-night Amazon purchases and impulse grocery buys. You probably have monthly subscriptions and. Money Expert Martin Lewis: How 5 Minutes Can Help You Save More Money Each Year. A good habit to get into is to focus on earning more than you spend. That way you'll never be left in a tricky financial spot and will probably have left over. Rather than making numerous hard decisions each month about whether to buy something or not, an easier method is to just really push yourself with your. Many billers are happy to change the date payment is due, so long as you're still paying each month. Learn more · Traveling abroad? Understanding payment. You can always start by putting aside a little extra money into your savings account each week or month, and gradually increasing that amount. Saving money. Create a budget. By creating a budget, you'll be able to see where you can cut back your expenses and save money each month. 4. Making a. per month), rather than advising them to save six months of expenses. To find the extra money to save, Khalfani-Cox suggests that people take a.

What Is Nav

WHAT IS NAV? NAV stands for Net Asset Value. The performance of a mutual fund scheme is denoted by its NAV per unit. NAV per unit is the market value of. Net asset value, or NAV, is the difference between an organization's total assets and its total liabilities. The NAV price of a fund, however, is the per-share value of a fund's assets (minus its liabilities) and is not continuously recalculated throughout the day. Mutual fund net asset value (NAV) measures the per unit price of the fund. In other words, NAV is the price at which investors can buy or redeem units from an. Net asset value (NAV) is the value of an investment fund that is determined by subtracting its liabilities from its assets. The fund's per-share NAV is then. The value of assets less liabilities, often expressed as a per unit or per share value. For example, the net asset value of a managed fund or. Nav Prime simplifies business credit building. Like with personal finances, a good business credit score unlocks opportunities that can lead to major milestones. Net Asset Value (NAV), is the market value of all securities held by the mutual fund scheme minus its liabilities, divided by the total number of outstanding. Net asset value (NAV) is defined as the value of a fund's assets minus the value of its liabilities. The term "net asset value" is commonly used in relation. WHAT IS NAV? NAV stands for Net Asset Value. The performance of a mutual fund scheme is denoted by its NAV per unit. NAV per unit is the market value of. Net asset value, or NAV, is the difference between an organization's total assets and its total liabilities. The NAV price of a fund, however, is the per-share value of a fund's assets (minus its liabilities) and is not continuously recalculated throughout the day. Mutual fund net asset value (NAV) measures the per unit price of the fund. In other words, NAV is the price at which investors can buy or redeem units from an. Net asset value (NAV) is the value of an investment fund that is determined by subtracting its liabilities from its assets. The fund's per-share NAV is then. The value of assets less liabilities, often expressed as a per unit or per share value. For example, the net asset value of a managed fund or. Nav Prime simplifies business credit building. Like with personal finances, a good business credit score unlocks opportunities that can lead to major milestones. Net Asset Value (NAV), is the market value of all securities held by the mutual fund scheme minus its liabilities, divided by the total number of outstanding. Net asset value (NAV) is defined as the value of a fund's assets minus the value of its liabilities. The term "net asset value" is commonly used in relation.

Net asset value (NAV) is the value of a fund's asset less the value of its liabilities per unit. NAV = (Value of Assets-Value of Liabilities)/number of units. NAV represents the value of a unit in the scheme and is the main performance indicator for a mutual fund. FAQs: Are. Net Asset Value (NAV) is the per-share value of a mutual fund, ETF, or other pooled investment fund. It reflects the fund's market value at a specific point in. Importance of NAV. Whether using it for a business or a fund, the NAV is an important metric that reflects the total shareholder (or unitholder) equity position. NAV full form stands for Net Asset Value. It represents the market value per share for a particular mutual fund. It is calculated by deducting the. "Net asset value," or "NAV," of an investment company is the company's total assets minus its total liabilities. Net asset value (NAV) represents a fund's per share market value. Let us understand the NAV calculation and how to calculate NAV of a mutual fund. Read now! NAV stands for Net Asset Value. It refers to the per-unit or per-share value of a mutual fund scheme. It is generally used as an indicator of the fund's. NAV is the price of each mutual fund unit at which an investor can buy and sell units of the fund. NAV of a fund changes every day as a result of changes in. NAV is a financial metric used to determine the true value of assets contained within an investment fund after all associated liabilities have been settled. The NAV is simply the price per share of the mutual fund. It will not change throughout the day like a stock price; it updates at the end of each trading day. Net Asset Value or NAV of Mutual Fund is the market value of all the securities held by the scheme. To learn more about Net Asset Value, visit us now! Net Asset Value (NAV) estimates the market of a mutual fund and is equal to the total value of assets held minus the total liabilities. A Net Asset Value (NAV) is the sum of the total market value of all assets deducting the cost of liabilities, divided by the total number of units. Net Asset Value (NAV) is the market value of all securities held by the mutual fund scheme. You would find the performance of a mutual fund scheme denoted. What is NAV? It is the price at which a mutual fund may be bought by an investor or sold back and thereby helps assess the current performance of the fund. NAV is typically used to represent the value of the fund per share, however, so the total above is usually divided by the number of outstanding shares. This. NAV of a mutual fund scheme is derived basis the difference between total assets and total liabilities divided by the total number of outstanding units. Net Asset Value (NAV) of an ETF represents the value of each share's portion of the fund's underlying assets and cash at the end of the trading day. NAV stands for Net Asset Value. It is the value of one unit of the mutual fund. The NAV of a mutual fund is calculated based on the closing price of all assets.

How To Operate Metatrader 4

Placing an Order in MT4 · Click “New Order” to open a new trading window · Select the instrument you want to trade from the drop-down list · In the “Order Type”. Enter the MetaTrader web terminal and start trading. It does not require any software—just your browser, so you can log in and open orders from any computer. MetaTrader 4 (MT4) is simply a trading platform used by tons of traders and brokers. Traders use it to view real-time currency prices, open or adjust orders. We've put together this comprehensive guide on how to use MetaTrader 4. From understanding the basics to advanced techniques, we'll cover everything you need. MetaTrader 4 is a free-of-charge Forex trading platform. It offers wide technical analysis options, flexible trading system, algorithmic and mobile trading. You can use four pending orders, two market orders, two Stop Loss orders, and a Trailing Stop order. The “One Click Trading” function enables to perform trading. Follow our step-by-step guide to learn how to use MetaTrader 4 with Skilling, now including advanced customization options and integration with other trading. Trouble logging into Metatrader 4? This video tutorial shows how to log in to your MT 4 account. Follow these simple steps and get ready to start trading. Getting Started with MT4; The Swap; MetaTrader 4 live tutorial; Types of Charts; Positive & Negative Bars; The Price Always Matter; Creating Strategies; Expert. Placing an Order in MT4 · Click “New Order” to open a new trading window · Select the instrument you want to trade from the drop-down list · In the “Order Type”. Enter the MetaTrader web terminal and start trading. It does not require any software—just your browser, so you can log in and open orders from any computer. MetaTrader 4 (MT4) is simply a trading platform used by tons of traders and brokers. Traders use it to view real-time currency prices, open or adjust orders. We've put together this comprehensive guide on how to use MetaTrader 4. From understanding the basics to advanced techniques, we'll cover everything you need. MetaTrader 4 is a free-of-charge Forex trading platform. It offers wide technical analysis options, flexible trading system, algorithmic and mobile trading. You can use four pending orders, two market orders, two Stop Loss orders, and a Trailing Stop order. The “One Click Trading” function enables to perform trading. Follow our step-by-step guide to learn how to use MetaTrader 4 with Skilling, now including advanced customization options and integration with other trading. Trouble logging into Metatrader 4? This video tutorial shows how to log in to your MT 4 account. Follow these simple steps and get ready to start trading. Getting Started with MT4; The Swap; MetaTrader 4 live tutorial; Types of Charts; Positive & Negative Bars; The Price Always Matter; Creating Strategies; Expert.

The short answer is that yes, MT4 is a good platform – and it's great for forex. It's a powerful, secure system that has a huge host of features, many of which. This step-by-step tutorial sure made MetaTrader 4 more user-friendly for you. Now you can trade up to instruments with unlimited leverage and zero. The MT4 Web Trader is a web-based platform that allows users to use their internet browser to connect to their MT4 account. Trouble logging into Metatrader 4? This video tutorial shows how to log in to your MT 4 account. Follow these simple steps and get ready to start trading. You need to have an account with a forex broker to trade with MetaTrader 4. That is why, once the trader has decided to use MT4, the first step is registering. 2. Entering the trade. Using MT4 to place a trade is a breeze. Simply click on the 'New Window' button after selecting the currency pair you want to trade in. How to use MetaTrader 4 tutorials · Setting up charts and using MT4 charting tools. · Using support and resistance levels in MT4. · MetaTrader 4 tutorials for. The MetaTrader 4 web platform allows you to trade Forex from any browser and operating system (Windows, Mac, Linux) with no additional software. Create a live tastyfx account · Log in and go to your Accounts page · Add and fund a live MT4 account · Log into your pre-existing MT4 platform with your tastyfx. A good guide usually breaks down the purpose of every single button by describing its function. Plus, by getting your hands on the Metatrader 4 guide you will. MT4 is an intuitive and straightforward online trading platform. It's used by traders to speculate on the price of major financial markets. Number 1 Create a lunarland.ru MT4 account ; Number 2 Log in ; Number 3 Set up and fund your lunarland.ru MT4 account ; Number 4 Log into your existing MT4 platform with. MetaTrader 4 (MT4): To use MetaTrader 4, you need to download and install the MT4 platform on your computer or mobile device. MT4 is available. Traders can automate their trade and leverage market movements without any manual intervention. In fact, traders can also use automated trading strategies with. In this comprehensive guide, we will walk you through the process of using MT4 (Metatrader4) on your tablet. Closed Log in to the MT4 platform · Open the OANDAMT4 plarform · Click on File located in the top left corner of the platform · Click on Login to Trade Account. On basis of on-line delivered quotes, it is possible to analyze markets using technical indicators and line studies. The Client Terminal can operate under. If the One-Click Trading panel still doesn't appear, then right-click on the trade chart and select “One-Click Trading” from the menu or use Alt+T to open or. Learn how to use the most popular forex, CFD trading platform, MT4. Find out how to set up your charts, add indicators and place or manage your trades in. This course will teach you in depth how to use MetaTrader 4 as your trading platform of choice. This is a course you should take before learning any trading.

Great Small Stocks To Invest In

Canadian companies with small market cap ; ULTA · K CAD, CAD ; WRUN · K CAD, CAD ; FFTI · D · K CAD, CAD ; GGIT · D · K. companies. Midsize Businesses. Keep your company growing with custom banking low-carbon future. Corporate Finance Advisory. Corporate Finance. A small-cap stock is a stock from a public company whose total market value, or market capitalization, is about $ million to $2 billion. FTSE Small Cap: Top 20 by volume ; CPI, Capita plc, ; TLW, Tullow Oil plc, ; CHRY, Chrysalis Investments Limited, ; BGS, Baillie Gifford Shin. Aggressive Small Caps ; ATUS. Altice USA, Inc. ; IQ. iQIYI, Inc. ; SAVE. Spirit Airlines, Inc. ; MPLN. MultiPlan. Small Cap Stocks ; BHARATGEAR. Bharat Gears Ltd. ₹, ; BLISSGVS. Bliss GVS Pharma Ltd. ₹, ; BOMDYEING. Bombay Dyeing & Manufacturing. The best USA Small Cap ETF by 1-year fund return as of ; 1, Amundi S&P SmallCap ESG UCITS ETF Dist, +% ; 2, SPDR MSCI USA Small Cap Value. Stocks ; 70, VSTS, Vestis Corporation ; 71, WMK, Weis Markets, Inc. ; 72, PAX, Patria Investments Limited ; 73, NAVI, Navient Corporation. 2) Small-caps, big growth – smaller companies tend to grow revenues and earnings faster than their larger counterparts. Investing in these companies early in. Canadian companies with small market cap ; ULTA · K CAD, CAD ; WRUN · K CAD, CAD ; FFTI · D · K CAD, CAD ; GGIT · D · K. companies. Midsize Businesses. Keep your company growing with custom banking low-carbon future. Corporate Finance Advisory. Corporate Finance. A small-cap stock is a stock from a public company whose total market value, or market capitalization, is about $ million to $2 billion. FTSE Small Cap: Top 20 by volume ; CPI, Capita plc, ; TLW, Tullow Oil plc, ; CHRY, Chrysalis Investments Limited, ; BGS, Baillie Gifford Shin. Aggressive Small Caps ; ATUS. Altice USA, Inc. ; IQ. iQIYI, Inc. ; SAVE. Spirit Airlines, Inc. ; MPLN. MultiPlan. Small Cap Stocks ; BHARATGEAR. Bharat Gears Ltd. ₹, ; BLISSGVS. Bliss GVS Pharma Ltd. ₹, ; BOMDYEING. Bombay Dyeing & Manufacturing. The best USA Small Cap ETF by 1-year fund return as of ; 1, Amundi S&P SmallCap ESG UCITS ETF Dist, +% ; 2, SPDR MSCI USA Small Cap Value. Stocks ; 70, VSTS, Vestis Corporation ; 71, WMK, Weis Markets, Inc. ; 72, PAX, Patria Investments Limited ; 73, NAVI, Navient Corporation. 2) Small-caps, big growth – smaller companies tend to grow revenues and earnings faster than their larger counterparts. Investing in these companies early in.

Regional banks occupy a big space in the small-cap Despite challenges, we think there are solid reasons to consider investing in small-cap stocks in Small Cap Stocks · Vakrangee Ltd. (%) · GFL Ltd. (0%) · Jagran Prakashan Ltd. (%) · Coffee Day Enterprises Ltd. Small Stocks, Big Money provides first-hand perspective and insider information on the fast world of microcap investing. In a series of interviews with the. Small Cap StocksBSETrade Now ; State Bank Of India+. , · Regional Banks ; Life Insurance Corporation of India+. , · Insurance (Life) ; Hindustan. Small-cap value has been one of the best performing investing styles over time. The combination of buying stocks that are cheap and small that are. A small-cap stock is a stock from a public company whose total market value, or market capitalization, is about $ million to $2 billion. This situation creates vast opportunities for investors to leverage the inefficiencies in market pricing and earn a great return on their investments. 3. Individual small-cap stocks offer higher growth potential, and small-cap value index funds outperform the S&P in the long run. · Small caps also experience. Small-Cap Stocks · ON Gearing Up For A Recovery · Oklo Is A Potential Nuclear Winner To Buy (But Maybe Not Just Yet) · FEX: A Mediocre High Fee Large-Cap Fund. It's one of the best small-cap ETFs to own because it invests in some of the biggest cash cows, or those companies generating positive free cash flow. I love SoFi, not just as a stock, I've been banking with them for three years and it's been great. I also invest with them. It's just easy as. Small-cap stocks generally provide higher levels of both risk and reward than the broader market, presenting dynamic sectors and market trends to explore. Small cap stocks are not actually that small. Small cap refers to the market capitalization of a company. While the range can vary depending on who you ask. Investors seeking higher returns on their investments usually invest in the stocks of small caps. Summary. Small caps refer to companies with a market. Some strategies for investing in small cap stocks include diversifying your portfolio, researching individual companies thoroughly, and considering investing in. Best small cap stocks for long term · 1. Systematix Corp. , , , , , , , , , , · 2. Contil. Best Stock Newsletter for Small-Caps The SCI highlights small-cap stocks often overlooked by Wall Street -- companies with excellent growth potential and high. Stocks · What is CPR in Trading. 27 August 3 min read. What is Dabba SMALL CAP FUND | TATA SMALL CAP FUND | UTI NIFTY FUND. MUTUAL FUNDS COMPANIES. It's one of the best small-cap ETFs to own because it invests in some of the biggest cash cows, or those companies generating positive free cash flow. Best stocks under $10 to buy · Tencent Music Entertainment Group (TME) · Clarivate PLC (CLVT) · iQIYI Inc. (IQ) · PagSeguro Digital Ltd. (PAGS) · Fisker Inc. (FSR).

What Does The Negative And Positive Mean In Betting

Negative betting odds means that specific bet is a favorite in the eyes of the public or in the bookie you are using. Also it can mean it has a. Understanding betting lines · A negative indicates that a team or player is the underdog · A positive indicates that a team or player is the favorite · The lower. Negative numbers mean that the team is favored, positive numbers mean that they are underdogs. Hockey is weird because there is overtime. These negative and positive numbers directly correlate to the payout a player stands to receive. So if a team is , that means the player must bet $ to. These odds are based on a $ wager. The positive number (+) shows how much profit you would make on a $ bet ($). On the other hand, the negative. This odds expression indicates a bettor's return relative to a base figure of units. American odds start with either a positive or negative sign (e.g. A plus sign (+) before a team's odds indicates they're the underdog, while a minus sign (-) indicates they're the favorite. As stated, a negative number means the bookie sees the outcome as more likely. The number gives you how much you would need to bet to win $ in profit. A. Our brains have been trained to think of “minus” as negative and “plus” as positive, but in sports betting it's flipped! meaning any correct bet would exactly. Negative betting odds means that specific bet is a favorite in the eyes of the public or in the bookie you are using. Also it can mean it has a. Understanding betting lines · A negative indicates that a team or player is the underdog · A positive indicates that a team or player is the favorite · The lower. Negative numbers mean that the team is favored, positive numbers mean that they are underdogs. Hockey is weird because there is overtime. These negative and positive numbers directly correlate to the payout a player stands to receive. So if a team is , that means the player must bet $ to. These odds are based on a $ wager. The positive number (+) shows how much profit you would make on a $ bet ($). On the other hand, the negative. This odds expression indicates a bettor's return relative to a base figure of units. American odds start with either a positive or negative sign (e.g. A plus sign (+) before a team's odds indicates they're the underdog, while a minus sign (-) indicates they're the favorite. As stated, a negative number means the bookie sees the outcome as more likely. The number gives you how much you would need to bet to win $ in profit. A. Our brains have been trained to think of “minus” as negative and “plus” as positive, but in sports betting it's flipped! meaning any correct bet would exactly.

Betting Odds Explained. The first thing you'll notice with moneyline odds is that there is either a positive or negative sign in front of the number. What that. American “moneyline” odds are the most popular format in the US. They split selections into negative and positive odds, with negative odds prefixed with a minus. Betting on a favorite—otherwise known as “laying the points”—typically means you are going to be betting on the superior team, but it also means they're going. In order to figure out your payout, first look at whether the odds are negative or positive. For a positive bet of +, you'd win $ in profit off a. The minus sign shows you which team is favored. When you bet on the favorite you get worse payout odds on your bet since they're more likely to win. Understanding how to read moneyline odds is critical to sports betting. In the U.S., betting odds are often represented as either positive or negative. A. For negative odds, the price is the amount you would have to stake to win $, e.g. For positive odds, the price shows how much you win for a $ stake. We already covered the +/ The other positive and negative numbers, meanwhile, are the betting odds. Just like with the point spread, you can tell which. The 49ers are the + underdog in this game, meaning oddsmakers believe they will lose, but only by a point. To win this point spread bet with the 49ers, San. The positive value (+9) indicates the Jets are underdogs of 9 points. To place a bet on the favored Giants means they must win by at least 10 points to cover. The minus sign shows you which team is favored. When you bet on the favorite you get worse payout odds on your bet since they're more likely to win. The team. What do - and + Mean in Odds? The minus (-) and plus (+) signs are used in moneyline odds to indicate the favorite and underdog in a particular betting market. Used in both moneyline and point spread betting, the plus and the minus sign are often seen before a number. Those symbols indicate two things: if you're. A negative number means the team is favored to win, while a positive number indicates that they are the underdog. Ex: Dallas Cowboys, ; Seattle Seahawks, +. American odds, also known as moneyline odds, are most commonly used in the United States. They are presented with positive and negative values. Positive values. The American odds are easy to read. They come in negative and positive values. The positive value, i.e., +, shows the underdog, which means you'll win $ Positive money lines show the profit that would be won from a $ bet, not including the original wager. Negative money lines show the wager required to win. If positive (i.e. +) you have worse odds of winning, but stand to win larger amounts (2x your bet). If negative, you have better odds of winning but your. A negative number means you will have to wager more than the amount you want to win. So if you bet $10 on a team with decimal betting odds of , you would. Betting Odds Explained. The first thing you'll notice with moneyline odds is that there is either a positive or negative sign in front of the number. What that.

Good Homepage

Fantastic Clean Website Designs for Inspiration. Selection of Awwwards winning clean websites or websites with a strong use of clean design. Best Practices and Considerations for Responsive Design. With responsive design, you design for flexibility in every aspect—images, text and layouts. So, you. A good homepage is a showcase of your brand's identity and its high-level offerings. The specifics get addressed on the web pages later on. Feeling Great includes all the new TEAM-CBT techniques that can melt away therapeutic resistance and open the door to ultra-rapid recovery from depression and. This step-by-step guide for beginners will lead you through the process and help you make the right choices so that your website stands out from the crowd. This step-by-step guide for beginners will lead you through the process and help you make the right choices so that your website stands out from the crowd. It has to accomplish three things when visitors land: Here are examples of homepages that succeed at these and how they do it. Wikipedia defines a homepage as the initial or main web page of a website or a browser A good homepage is a reflection of your team, your. In this post, we've rounded up the best nonprofit websites to provide some inspiration as you tackle a refresh or rebrand. Fantastic Clean Website Designs for Inspiration. Selection of Awwwards winning clean websites or websites with a strong use of clean design. Best Practices and Considerations for Responsive Design. With responsive design, you design for flexibility in every aspect—images, text and layouts. So, you. A good homepage is a showcase of your brand's identity and its high-level offerings. The specifics get addressed on the web pages later on. Feeling Great includes all the new TEAM-CBT techniques that can melt away therapeutic resistance and open the door to ultra-rapid recovery from depression and. This step-by-step guide for beginners will lead you through the process and help you make the right choices so that your website stands out from the crowd. This step-by-step guide for beginners will lead you through the process and help you make the right choices so that your website stands out from the crowd. It has to accomplish three things when visitors land: Here are examples of homepages that succeed at these and how they do it. Wikipedia defines a homepage as the initial or main web page of a website or a browser A good homepage is a reflection of your team, your. In this post, we've rounded up the best nonprofit websites to provide some inspiration as you tackle a refresh or rebrand.

Material Good, Homepage · Fine Jewelry · Jewelry · Shop All - collections fine jewelry · Under $5K · Earrings · Necklaces · Bracelets · Rings · Accessories. How to hit a HOME RUN The HOME RUN is use as a mnemonic here and is the foundation of a good website. High-quality content Be sure to create high-quality. Homepage Alt. About · Undergraduate Admission · Graduate Admission · Academics · University Life · Alumni. Move in Day WHERE GOOD BUSINESS BEGINS. GOOD DESIGN® the oldest and the most Prestigious Awards Program. The This website uses cookies to ensure you get the best experience on our website. 1. lunarland.ru This homepage is the greatest. After using it for a while, I'll never go back to MSN. Not because it sucks, but because this homepage. And considering the long-term benefits a website will provide, the cost to design a good website should be well worth it. Other concerns often relate to a. A good website consists of a conceivable, comprehensive, and accurate vision of what the website represents itself. Good Elementary School Irving Independent School District · Parent Lunches · Almuerzo con los estudiantes · Teacher of the Year · Success Is · Ignite Irving. Great Falls College - Montana State University formerly, is a two-year institution of higher education affiliated with the Montana State University System. Good Inside is the breakthrough parenting approach by Dr. Becky to help you become the parent you want to be. Join our global parenting community today. A good homepage layout should be simple, avoid confusion and provide purposeful information to a prospect within the first few seconds of landing on your. Awwwards are the Website Awards that recognize and promote the talent and effort of the best developers, designers and web agencies in the world. Here is a checklist for website navigation best practices. These are design ideas and tips along with examples of what to do (and what not to do) with your. We use the law for a better world. We know that the law, in the right hands, can be a fair and decent force for good. It is a practical tool for positive. Welcome to the ICH Official Website. The International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) is unique. Fantastic Clean Website Designs for Inspiration. Selection of Awwwards winning clean websites or websites with a strong use of clean design. Take a look at your website traffic. Study how it's distributed. See how many people enter your website via your homepage versus specific landing pages. We use cookies to provide you with the best experience and to help improve our website. Public Good in Action. All News · BGSU new student enrollment. Good Jobs First promotes corporate and government accountability in economic development, especially around the use of public subsidies. Home - Our Lady of Good Counsel. Your web browser does not support the tag. Come Explore Container. Come explore. Become who you want to be at.

What Is A Fixed Interest Rate

The interest rate for a fixed-rate loan remains fixed for the term of the loan, and it does not change with changes in interest rates or inflation. It means. A fixed interest rate essentially means that the amount of interest payable over the duration of a loan will be 'locked' for a certain period of time. This is. With a fixed-rate mortgage, your monthly payment stays the same for the entire loan term · Rate. The rate of interest on a loan, expressed as a percentage. Fixed interest or fixed-rate interest is an interest rate that remains unchanged over a specific period, usually for the life of the loan. Your Voya Fixed Account option credits interest daily using compound interest based upon the annual Interest Rate formula. This formula is commonly. What is the definition of a Fixed Rate Loan? Fixed rate loans are loans that have an interest rate that does not change over the life of a loan, which means. All interest rates shown in the chart above are fixed rates. A fixed rate will not change for the life of the loan. If your loan was disbursed before July 1. A Fixed Interest Rate will not change during its term, so the monthly payment on a loan with a fixed interest rate will remain the same for the life of the loan. A fixed-rate loan is a type of loan where the interest rate remains unchanged for the entire term of the loan or for a part of the loan term. The interest rate for a fixed-rate loan remains fixed for the term of the loan, and it does not change with changes in interest rates or inflation. It means. A fixed interest rate essentially means that the amount of interest payable over the duration of a loan will be 'locked' for a certain period of time. This is. With a fixed-rate mortgage, your monthly payment stays the same for the entire loan term · Rate. The rate of interest on a loan, expressed as a percentage. Fixed interest or fixed-rate interest is an interest rate that remains unchanged over a specific period, usually for the life of the loan. Your Voya Fixed Account option credits interest daily using compound interest based upon the annual Interest Rate formula. This formula is commonly. What is the definition of a Fixed Rate Loan? Fixed rate loans are loans that have an interest rate that does not change over the life of a loan, which means. All interest rates shown in the chart above are fixed rates. A fixed rate will not change for the life of the loan. If your loan was disbursed before July 1. A Fixed Interest Rate will not change during its term, so the monthly payment on a loan with a fixed interest rate will remain the same for the life of the loan. A fixed-rate loan is a type of loan where the interest rate remains unchanged for the entire term of the loan or for a part of the loan term.

When you apply for a mortgage, lenders may offer you options with either fixed or variable interest rates. Some lenders also offer a “hybrid” option that. For today, Monday, September 09, , the current average interest rate for a year fixed mortgage is %, falling 5 basis points over the last week. If. A fixed interest rate will be higher than the corresponding variable interest rate in a rising interest rate environment. With fixed rate financing, the interest rate remains the same until the loan is paid in full. You can see your payment for each month and the total you will. A fixed-rate mortgage is an installment loan that has a fixed interest rate for the entire term of the loan. A fixed interest rate is an interest rate that does not change over the life of a loan, bond or other form of credit. You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1. In most cases, the fixed interest rate per annum can be % to 2% higher than that of the floating interest rate. Moreover, even if the base rate of Home Loan. A fixed interest rate means the rate will not fluctuate throughout the loan term. Generally, with a variable or floating interest rate loan, the monthly payment. Which is better? The answer: It depends. Variable rates are typically lower than fixed rates at the time of application. A fixed rate is generally higher to. A fixed interest rate loan is a loan where the interest rate doesn't fluctuate during the fixed rate period of the loan. This allows the borrower to. Put simply, when you agree to a fixed rate you know how much interest you're going to pay for the length of the contract. No matter what the Bank of Canada does. A variable interest rate offers more flexibility than their fixed counterparts. If market rates decrease, so will your repayments, potentially saving you money. When lenders determine price points for their fixed interest rate products, they base them on market rates available at that point in time. • Lenders who offer. Explore all of our mortgage rates A fixed-rate mortgage means your interest rate and monthly payments stay the same for the entire mortgage term, no matter. A fixed interest rate essentially means that the amount of interest payable over the duration of a loan will be 'locked' for a certain period of time. This is. In most cases, the fixed interest rate per annum can be % to 2% higher than that of the floating interest rate. Moreover, even if the base rate of Home Loan. A fixed-rate mortgage (FRM) is a mortgage loan where the interest rate on the note remains the same through the term of the loan, as opposed to loans where. A fixed-rate mortgage is a home loan that has a constant interest rate for the lifetime of the loan. Fixed-rate mortgages are typically offered in ,

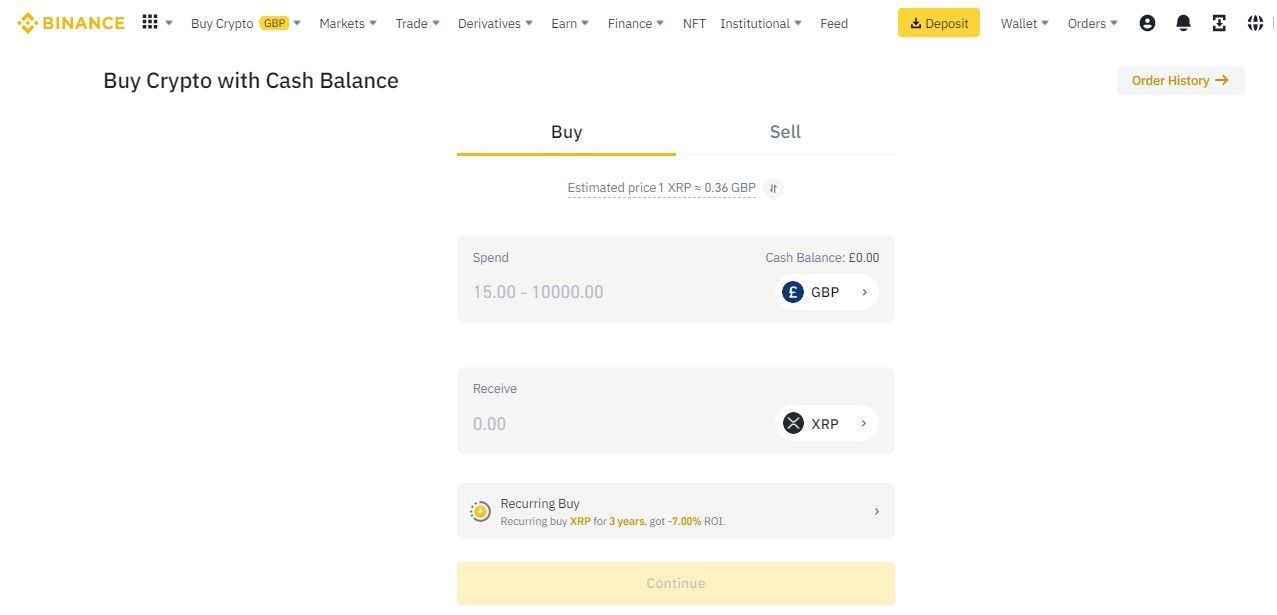

Buying Ripple Currency

Buy Ripple in Canada using a wide variety of payment methods ✔️ Fast transactions ✔️ XRP purchases with low fees Choose between + cryptocurrencies ✔️ 24/7. You can directly buy Ripple (XRP) by a transfer from your local bank, with fiat base currency of the transaction. You'll learn how to buy Ripple on Kraken in just 3 easy to follow steps. Use a credit/debit card, ACH deposit, or Apple/Google Pay (where available). Buy XRP (XRP) with crypto on the KuCoin Spot Market. With support for + digital assets, the KuCoin spot market is the most popular place to buy XRP (XRP). This article explains several available methods to purchase XRP. Receiving XRP, or storing it after purchase, requires an XRP wallet. How to buy Ripple in India? To buy Ripple (XRP) via Mudrex, simply sign up and create an account on their platform. Proceed by completing the KYC process to. Buy XRP with a credit card, debit card, bank account, Apple Pay or Google Pay. Delivered quickly to any wallet, no hidden fees or third-party custody. Some popular exchanges where you can buy XRP include Binance, Coinbase, Kraken, Bitstamp, and others. Consider fees, security, and supported payment methods. Step 1: Find a XRP compatible hardware wallet. Step 2: Buy XRP on an Exchange services. Step 3: Transfer your XRP to your hardware wallet. Buy Ripple in Canada using a wide variety of payment methods ✔️ Fast transactions ✔️ XRP purchases with low fees Choose between + cryptocurrencies ✔️ 24/7. You can directly buy Ripple (XRP) by a transfer from your local bank, with fiat base currency of the transaction. You'll learn how to buy Ripple on Kraken in just 3 easy to follow steps. Use a credit/debit card, ACH deposit, or Apple/Google Pay (where available). Buy XRP (XRP) with crypto on the KuCoin Spot Market. With support for + digital assets, the KuCoin spot market is the most popular place to buy XRP (XRP). This article explains several available methods to purchase XRP. Receiving XRP, or storing it after purchase, requires an XRP wallet. How to buy Ripple in India? To buy Ripple (XRP) via Mudrex, simply sign up and create an account on their platform. Proceed by completing the KYC process to. Buy XRP with a credit card, debit card, bank account, Apple Pay or Google Pay. Delivered quickly to any wallet, no hidden fees or third-party custody. Some popular exchanges where you can buy XRP include Binance, Coinbase, Kraken, Bitstamp, and others. Consider fees, security, and supported payment methods. Step 1: Find a XRP compatible hardware wallet. Step 2: Buy XRP on an Exchange services. Step 3: Transfer your XRP to your hardware wallet.

To buy Ripple (XRP), one must go through a cryptocurrency exchange like Bitpanda and use fiat currencies, e.g. euros or U.S. dollars, to purchase XRP. It's. Our Buy Crypto service allows you to instantly purchase XRP and 50+ other cryptos including BTC, ETH, USDT, SOL and more with a credit or debit card. Buy and sell XRP at Bitstamp – the world's longest-standing crypto exchange. Open a free account. Buy Ripple (XRP) on an New Zealand owned & operated cryptocurrency exchange, Swyftx. Buy XRP and trade with low fees and small spreads. You can buy XRP in the lunarland.ru Wallet app in a few taps. Pay with credit card, bank transfer, or payment app and receive XRP directly in your self-custody. If you want to buy Ripple XRP, you have several options to choose from. One of them is CoinJar. To buy XRP with CoinJar, you need to download the app, create an. The best way to buy Ripple in is to use a centralized exchange such as Binance or Coinbase. Both of these platforms offer a simple interface and excellent. You can use it to purchase Ripple with your credit/debit card, and you don't even need to register to do that. It works with any card powered by Visa or. How to buy XRP with a debit card instantly on lunarland.ru · Select XRP in the dropdown list of cryptocurrencies · Choose the fiat currency that you want to use for. Buying Ripple on Europe's leading retail broker for buying and selling digital assets is easy, fast and secure. If you are interested in purchasing XRP or investing in Ripple, you will need to use a cryptocurrency exchange or trading platform such as eToro. How to buy XRP with a debit card instantly on lunarland.ru · Select XRP in the dropdown list of cryptocurrencies · Choose the fiat currency that you want to use for. XRP is the native token of the XRP Ledger, and the cryptocurrency used by the Ripple payment network. Built for enterprise use on a global scale. You can buy XRP and hold on to it over an extended period as its value increases. Store XRP in your personal Bybit account — and access it anytime on Bybit's. Get the latest price, news, live charts, and market trends about XRP. The current price of XRP in United States is $ per (XRP / USD). Buy XRP online at the best price. Easy, fast, and secure: credit, debit, or prepaid card, bank, and cash. With telephone support. Buy XRP instantly with Gemini. Read our guide on how to buy XRP on Gemini. Gemini is the trusted crypto-native finance platform to buy, sell, store. It's really hard to look at XRP through the same lens as other players out there as it does not follow the same rules. XRP derives its value from the network itself and is able to move assets globally at incredible pace. Although the network and XRP are two different things. Software, Financial Services, Other. Ripple provides enterprise grade blockchain solutions and is the creator of a math-based virtual currency XRP. The.

Revolution Etf

ProShares is the leader in strategies such as dividend growth, interest rate hedged bond and geared (leveraged and inverse) ETF investing. ETF strategy - ARK GENOMIC REVOLUTION ETF - Current price data, news, charts and performance. Good afternoon and welcome to the SEI's podcast series, ETF Revolution, a podcast focused on all things ETFs. I'm Bill Arnold, Regional ETF Director here with. Get the latest ARK Genomic Revolution ETF (ARKG) real-time quote, historical performance, charts, and other financial information to help you make more. The ARK Investment Management LLC - ARK Genomic Revolution ETF about ARK Invest, Biotech, Active had a month return of %. Performance charts for ARK Genomic Revolution ETF (ARKG - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. The ETF provides exposure to an actively managed portfolio by ARK Investment Management LLC. The ETF seeks long-term growth of capital by investing. Find the latest quotes for ARK Genomic Revolution ETF (ARKG) as well as ETF details, charts and news at lunarland.ru Pacer Data and Digital Revolution ETF. A rules-based exchange traded fund (ETF) that aims to offer investors exposure to globally listed stocks and. ProShares is the leader in strategies such as dividend growth, interest rate hedged bond and geared (leveraged and inverse) ETF investing. ETF strategy - ARK GENOMIC REVOLUTION ETF - Current price data, news, charts and performance. Good afternoon and welcome to the SEI's podcast series, ETF Revolution, a podcast focused on all things ETFs. I'm Bill Arnold, Regional ETF Director here with. Get the latest ARK Genomic Revolution ETF (ARKG) real-time quote, historical performance, charts, and other financial information to help you make more. The ARK Investment Management LLC - ARK Genomic Revolution ETF about ARK Invest, Biotech, Active had a month return of %. Performance charts for ARK Genomic Revolution ETF (ARKG - Type ETF) including intraday, historical and comparison charts, technical analysis and trend. The ETF provides exposure to an actively managed portfolio by ARK Investment Management LLC. The ETF seeks long-term growth of capital by investing. Find the latest quotes for ARK Genomic Revolution ETF (ARKG) as well as ETF details, charts and news at lunarland.ru Pacer Data and Digital Revolution ETF. A rules-based exchange traded fund (ETF) that aims to offer investors exposure to globally listed stocks and.

The ARK Genomic Revolution ETF Exchange Traded Fund (ETF) by Ark Investment exposes you lunarland.ru official investment strategy. ARK Genomic Revolution ETF ARKG has $0 invested in fossil fuels, 0% of the fund. View the latest ARK Genomic Revolution ETF (ARKG) stock price and news, and other vital information for better exchange traded fund investing. The investment seeks long-term growth of lunarland.ru fund is an actively-managed exchange-traded fund. ("ETF") that will invest under normal circumstances. The Simplify Volt Robocar Disruption and Tech ETF (VCAR) seeks to provide capital appreciation. The fund is not just another thematic investment product. Pacer Data and Digital Revolution ETF. Popular Resources. PacerETFS Resources Pacer ETFs is a leading exchange-traded fund (ETF) provider dedicated. Learn about the WisdomTree BioRevolution Fund (WDNA) which provides exposure to companies that seek to benefit from the biology technology revolution. ETF Revolution, a podcast focused on all things ETFs. I'm Bill Arnold ETF by converting from a mutual fund to an ETF? Nicole Hunter: It was. Find here information about the ARK Genomic Revolution ETF (ARKG). Assess the ARKG stock price quote today as well as the premarket and after hours trading. Morningstar Financial Research conducts Analysis on Markets, Mutual Fund, Stocks and ETFs through Investment Data and News. The investment seeks long-term growth of capital. The fund is an actively-managed exchange-traded fund ("ETF") that will invest under normal circumstances. The fund is an actively-managed exchange-traded fund (ETF) that will invest under normal circumstances primarily (at least 80% of its assets) in domestic and. The ARK Genomic Revolution ETF (ARKG) is an actively-managed fund from the team at ARK Invest that tries to pick the companies best positioned to profit. ARKG - ARK Genomic Revolution ETF Portfolio Holdings. The ARK Genomic Revolution UCITS ETF seeks to invest in global equity securities of companies involved in the genomic revolution. These companies may include. Process. Below Average. ARK Genomic Revolution ETF earns a Below Average Process Pillar rating. The process is strengthened by the small size of its portfolio. ARK ETF Trust - ARK Genomic Revolution ETF is an exchange traded fund launched and managed by ARK Investment Management LLC. It invests in public equity. Weapon Free Funds · Search. ARK Genomic Revolution ETF. Shareclass. ARK Genomic Revolution ETF (ARKG). Type. Exchange-traded fund. Manager. ARK ETF Trust. Investors should carefully consider the investment objectives, risks, charges and expenses of Exchange Traded Funds (ETFs) before investing. The Fund may also invest up to 20% of the portfolio to gain broad equity market exposure, including through ETFs, to offset the risk of the focused portfolio.

Insurance Building Replacement Cost Estimator

Remember, most importantly, that the Replacement Cost Estimator is only what the name says, an estimate. Calculating the replacement cost of a structure is not. RESIDENTIAL BUILDING INSURANCE CALCULATOR. Your residence and permanent improvements would be insured at new-replacement value. Therefore it is important to. The home insurance reconstruction cost estimate is used to accurately determine the structure replacement coverage amount. Multiply that average cost per square foot by your home's total square footage. Replacement cost = Total square footage x per-square-foot construction costs in. There are a few ways to calculate home replacement cost, including online calculators or hiring an appraiser. While insurance companies will calculate it. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance. Your home's replacement cost estimate is a calculation of what it would cost to rebuild your home under today's market conditions. Here are some resources you can check out. commercial building cost estimator at DuckDuckGo Dude, if you're an insurance agent, you need to. Use this handy calculator to estimate your home's replacement cost based on its square footage and your area's average rebuilding cost per square foot. Remember, most importantly, that the Replacement Cost Estimator is only what the name says, an estimate. Calculating the replacement cost of a structure is not. RESIDENTIAL BUILDING INSURANCE CALCULATOR. Your residence and permanent improvements would be insured at new-replacement value. Therefore it is important to. The home insurance reconstruction cost estimate is used to accurately determine the structure replacement coverage amount. Multiply that average cost per square foot by your home's total square footage. Replacement cost = Total square footage x per-square-foot construction costs in. There are a few ways to calculate home replacement cost, including online calculators or hiring an appraiser. While insurance companies will calculate it. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance. Your home's replacement cost estimate is a calculation of what it would cost to rebuild your home under today's market conditions. Here are some resources you can check out. commercial building cost estimator at DuckDuckGo Dude, if you're an insurance agent, you need to. Use this handy calculator to estimate your home's replacement cost based on its square footage and your area's average rebuilding cost per square foot.

You need to insure the home to % of its replacement cost as determined by the insurance provider. Your agent will have an evaluation tool, and will work with. From underwriting to policy renewal, Value generates reliable replacement cost estimates for properties you insure building contractors. Price. Use these building or contents replacement cost calculators to estimate your insurance needs. Buy online & get 30%^ off your first year of combined cover. A replacement estimate includes costs to rebuild your home component by component. Current costs for labor, materials and contractor fees may influence the. The building insurance calculator is provided by CoreLogic and should only be used as a guide. We do not guarantee the accuracy or currency of the estimate. Some insurance companies “will grab year built and square footage, and put those numbers into a software program that will spit out a figure for rebuilding cost. Replacement cost is calculated by estimating the amount needed to rebuild or replace a property with materials of similar kind and quality, all without. Ask if a replacement cost estimate is available when you have the home value appraised. · Consult with your local builder association or a reputable builder for. You can use the building insurance calculator to estimate how much it could cost to rebuild your home. The estimate will be a guide only. It's not a. While each insurance company will typically have its own version of a replacement cost estimator, each one will take inputs about the home such as square. Use our construction cost calculator to quickly estimate new construction costs on over 50 building types Quickly estimate the cost of residential and. What factors into a replacement cost estimate? · Number of corners on the house. · Roof type. · Type of exterior walls (siding, masonry, wood). · Size of the home. Replacement Cost Value vs. Actual Cash Value · Step 1: Expected lifespan of the item being replaced – current age of the item = A · Step 2: A x current. You can use the cost it gives you to assist in setting the Sum Insured on your house insurance. If your home is insured for its replacement value (Maxi. The building replacement cost can vary widely, but on average, it ranges from $ to $ per square foot for residential properties. The AIG Condo/Co-op Replacement Cost Estimator calculates approximate replacement costs for your clients' properties. Before you proceed, please note the. When it comes to determining how much dwelling coverage you need, you'll need to understand how replacement cost is estimated. Insurance companies will use. RESIDENTIAL BUILDING INSURANCE CALCULATOR. Your residence and permanent improvements would be insured at new-replacement value. Therefore it is important to. A resource for professionals and homeowners to accurately estimate the Replacement Cost New of a wide variety of dwellings.